Project 6: Model order reduction for parametric high dimensional models in the analysis of financial Risk

Project Partners:

Research Center MATHEON / TU Berlin, Germany

MathConsult GmbH, Austria

Project Scientists:

ESR06

Onkar Sandip Jadhav

Volker Mehrmann, TU Berlin

Technische Universität Berlin

Institut für Mathematik

Straße des 17. Juni 136

D-10623 Berlin

Email: mehrmann@math.tu-berlin.de

Tel.: +49 (0)30 314-25736

Andreas Binder, MathConsult GmbH

Altenbergerstraße 69

4040 Linz, Austria

Email: andreas.binder@mathconsult.co.at

Tel.: +43/732 2468 4211

Project Description:

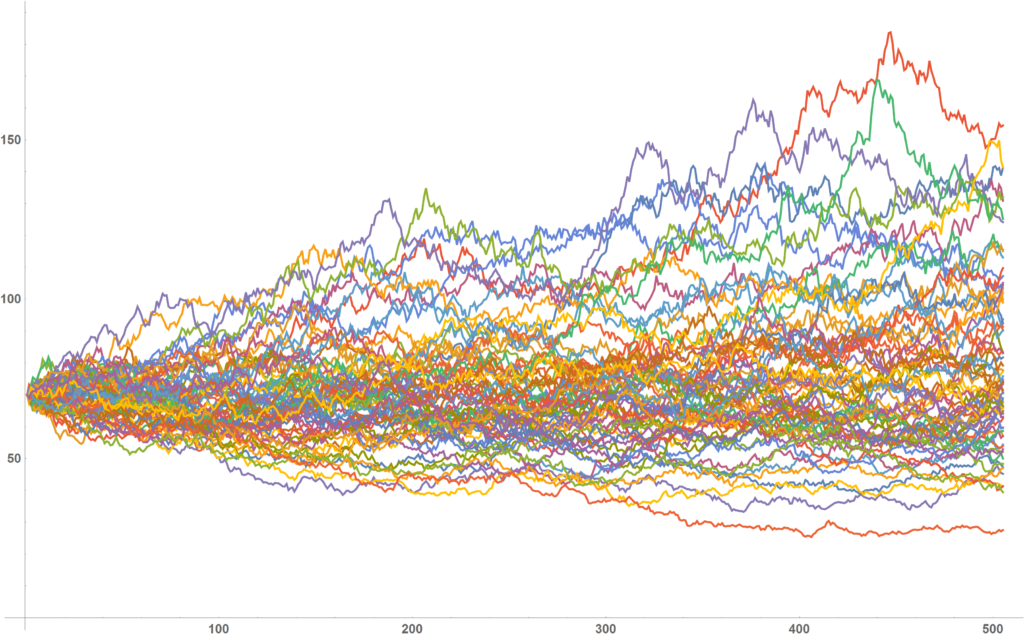

In Computational Finance potential developments of assets and/or liabilities are usually modeled via Monte Carlo (MC) simulation of the underlying risk factors. For the valuation of financial instruments, however, techniques based on discretized convection-diffusion-reaction PDEs are often superior. The solution of these high-dimensional problems requires sparse representations in tensor formats and an adaptation of the iterative solvers to this format. Objectives of this research project are the development of hierarchical and data sparse tensor representations for MC and PDE methods arising in the valuation of financial risk.

Moreover, model order reduction methods for high-dimensional systems in tensor format have to be derived. These will include projection based reduced order modeling techniques based on adaptive eigenvalue/singular value techniques with error estimates in tensor formats and for model hierarchies. The objectives of the research also include the comparison of MC and PDE techniques and the implementation of efficient algorithms.